|

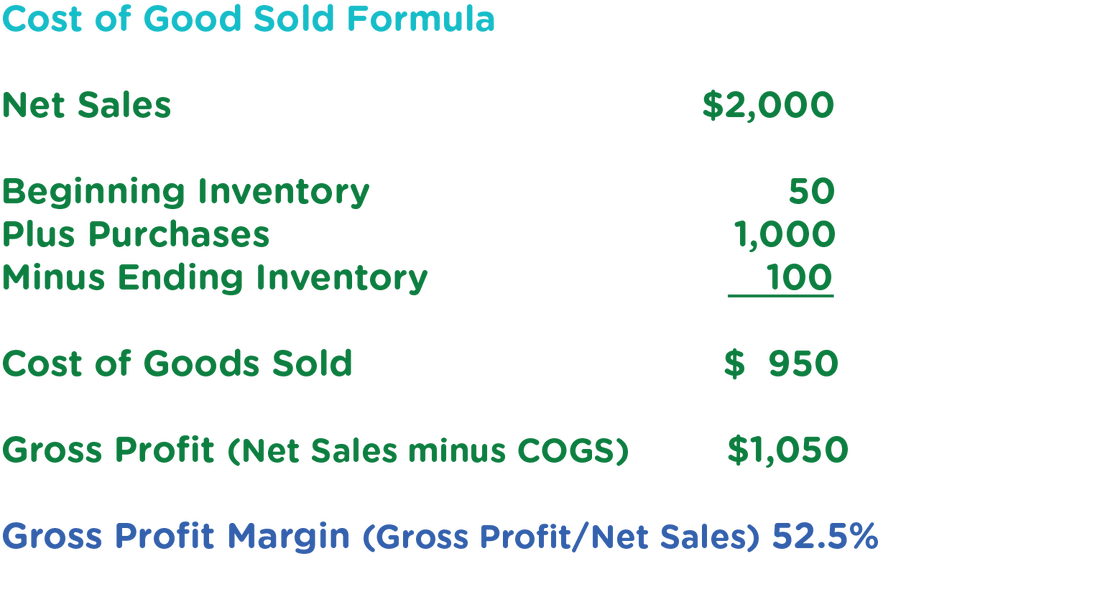

Many companies don’t really understand what a cost of goods sold is and don’t calculate it correctly. I’m going to tell you why that’s dangerous. I get endless writing fodder from my clients. I am currently working with a company that is acquiring another company. My partner and I were retained to calculate a valuation and propose an appropriate deal structure. Easy peasy. Right? Wrong. The target company is a manufacturing company and their cost of goods sold (COGS) was wrong in six ways from Sunday leading to an inaccurate gross profit margins. It is difficult to value a company without a solid COGS and gross profit number. Further, it is difficult to make decisions about your company if you don’t know what your COGS is.  COGS Formula Let’s start with the formula for COGS: beginning inventory plus purchases minus ending inventory. That’s it and it is logical. It’s what you started with (beginning Inventory) plus what you purchased to add to that (purchases) less what you have left over (ending inventory). Why subtract ending inventory? Logically, because it is the Cost of Goods Sold. If you don’t sell it, subtract it out and it will be your ending inventory for this period and your beginning inventory for the next period. Yes, it is calculated for a particular time period. For small companies that is usually monthly, quarterly and then at year end. The idea is that you want to find out exactly what it has cost you to make or buy the products you sell for that time period. So it is only that. Not sales commissions or whatever it cost you to sell them. Not what it cost you to store everything in your parent’s garage. Not what it cost you to make samples or go to trade shows or advertise. None of that. Just, what it costs to make your products. The only exception to this rule is if you are doing your own actual manufacturing. Then you can include factory overhead expense into COGS for the time period in question. Inventory Valuation To drill down to the component parts, inventory is the entire cost of your products to get it to your warehouse and only that cost. Not what you’re going to charge your customers or retailers. That’s your wholesale price (if your selling to stores) or your customer price (if you’re selling directly to customers). And inventory should always be the lower of cost or market value. So if it cost you $10 to make a widget and you make 100 widgets, then the total value of your inventory is $1,000. If the market value (what you are going to sell it for) is $5,000, your inventory number is still $1,000. ( Lower of cost or market.) But if the market crashes for your widgets and you can only sell them for $500, then your inventory should be listed at its market value of $500. ( Lower of cost or market.) A note about the gray area of inventory valuation It is very easy to manipulate your inventory to make more money or lose more money. It is the easiest way to affect profits and losses in business. Why would one want to do that? If you have bank loans that require you to make a certain amount of profit, you would want to value your inventory as high as you can. If you have a privately held company and your goal is to pay the least amount of taxes, you would want to write-off inventory that has aged, as much as reasonably possibly. I am not suggesting you do that because you need to show an accurate inventory valuation and you don’t want to get in trouble with banks or the IRS, however, it is something that is often done. Don’t do it. And by the way, it will eventually catch up to you down the road. Purchases Purchases should include the total that you paid for your widgets, $1,000 in my example, and how much it cost you to ship it into your warehouse or parent’s garage (part of your cost and called “freight-in”). If you are importing, you should also add in customs and duties as a part of the freight-in cost. Manufacturing If you are manufacturing it gets a bit more complicated. In that case you have to add together purchases of all the raw materials required to make your widgets and still include freight-in that will hopefully be less than shipping it from a foreign country if you’re using parts made nearby. In this case your inventory number should also include raw materials and work-in-process (or progress), or WIP.

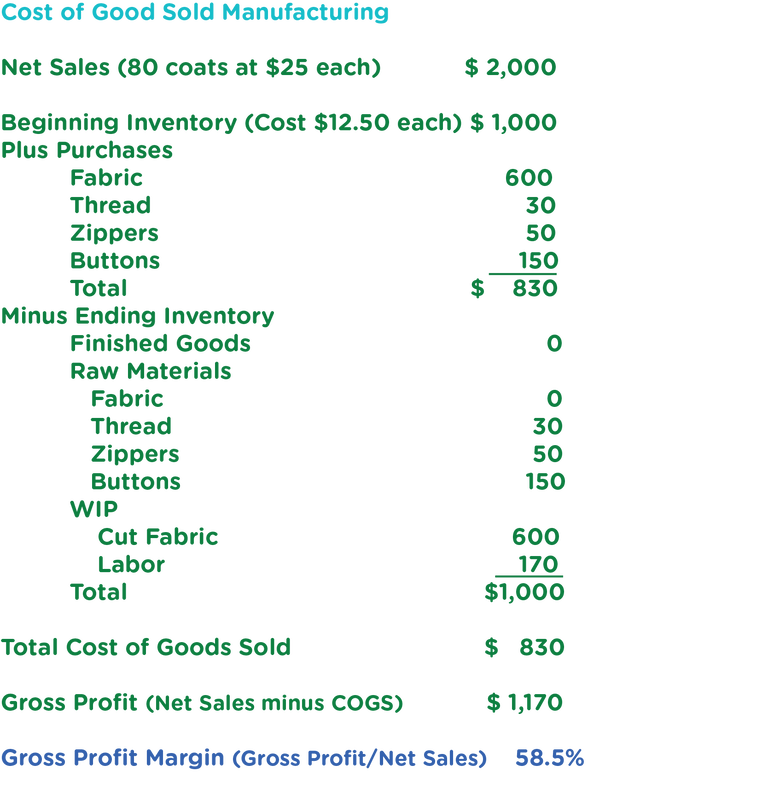

Let’s say you are manufacturing coats. You have an order for 80 coats at $25 each. Luckily you start out with 80 coats that cost you $12.50 to make. But you want to make more inventory in case you receive more orders. You buy the fabric locally and ship it to your factory. You also purchase thread, buttons, zippers and tags (raw materials). At the end of your reporting period, 12/31/22 (called a fiscal year), you had personal problems and were only able to cut the coats out of the fabric. Since you haven’t sewn and finished them, they are considered WIP. Your purchases would be all the raw materials that your company purchased along with the cost to ship them to you. Your ending inventory number would include any finished inventory (that you don’t have in this example), all of the raw materials that you haven’t used yet and WIP (which now includes all your fabric because you cut it). Your only sales (since you haven’t finished making your coats), were from beginning inventory or the coats you made from last period. Why your COGS is so very important Now that we know how to calculate an accurate COGS, let’s discuss why it is so very important. You need an accurate COGS to calculate your gross profit. You must have an accurate gross profit to make important decisions about your company, to price your goods and to ascertain if you’re making any mistakes so you can fix them. As an example, If your gross profit is too high, you may be charging too much for your products and by lowering your prices, you could increase your sales enough to more than compensate for your lower prices. If your gross profit is too low, maybe you are not charging enough and could raise your prices, sell the same amount and make more money. A major problem with a COGS that is too high, is that you purchased too much inventory. That eats into your COGS percentage as well as your cash flow. It can also be that you paid more than you estimated for your products or raw materials. Sometimes, freight-in costs can be increased at the last minute (a problem with many companies in the last year). I’ve even seen companies that forgot to add in an important raw material when pricing their product. Try to add a cushion into your pricing too account for problems that crop up. For more information about pricing read my November 2019 article, “The Art of Pricing.” Cash flow problems with inventory At a minimum, you must make enough gross profit to pay your overhead expenses such as design, marketing, sales, rent and salaries. If you purchase too many products, much more than you have orders for or more than you can sell, that is going tie up your money in inventory and you may not have enough cash flow to operate your business. I’ve seen many small companies go under because the cash they need to run their company is sitting in their warehouse in the form of inventory that can’t be sold. Often this happens because there are certain minimum order quantities they must purchase. And people think their products are great which they may be, but they are overconfident that they can sell them. For more information on cash flow, read my March 2020 article, “Why Cash is King and How to Get More of It.” In closing, keep a handle on what it takes to manufacture or purchase your products. It will be the foundation of your decision-making and most importantly, the source of your cash.

0 Comments

|

Stories and snippets of wisdom from Cynthia Wylie and Dennis Kamoen. Your comments are appreciated.

Archives

June 2024

Categories |