Road Trip with Raj@roadtripwithraj Road Trip with Raj@roadtripwithraj In the next couple weeks, a friend’s business is going to shut down and close its doors. Their customers canceled all outstanding orders. The only channel left for them is online sales, where their gross profit margin is 4%. Yes, gross profit margin, not net profit margin. In the meantime, their overhead costs are continuing unabated, eating all their available cash like a Pac-Man at warp speed. How can this company be saved? I reflect on that now ghostly column started in 1952 in Ladies’ Home Journal, “Can This Marriage Be Saved”? A long time ago when I was a young girl, I would read my mom’s copy each month. Marveling at how poorly husbands and wives treated each other I thought, quite decidedly, that I would never ever get married. But if I did, I would never let my spouse treat me so shabbily! Even today, if you Google, ‘can this marriage be saved’, there are over eight million results ranging from deep psychological probing to reading the ‘signs’ to taking pop quizzes, ostensibly because you cannot read the signs. If you Google, ‘can this company be saved’, there are precious few results. Most are about saving money, a component to be sure, but not really about saving the entire company. The thing is, I’m not really interested in the question, can this company be saved? I’m more interested in how this company can be saved. I’ve had more than a dozen of my former clients and friends call me in the last couple of weeks. They are understandably concerned about whether or not their companies are going to survive. This is something on everyone’s mind in the age of Covid-19 and the lockdown of America and the rest of the world. It’s everyone from CEOs and investors to bookkeepers and shipping clerks. I suppose the good news is that we’re all in this together and to some extent, we can assuage ourselves with the camaraderie of the situation. But if you own or run a company, the most vital question is, can it be saved? And how can it be saved? Doug Yakola has been running recovery programs for over twenty years from the prestigious management consulting firm McKinsey & Company. In a post about leading a company out of crisis, he explains that even good managers are often working under a set of paradigms that no longer apply while letting the power of inertia carry them along. Nothing like a worldwide shutdown to shift your paradigm. The good news is, we all know that the rules have changed. So here we are, now what do we do? Leaders need to make tough decisions and act quickly. To navigate these challenging times, executive leaders need to make tough decisions, act quickly and remember that the number one goal is to save the company while minimizing collateral damage to your community and workers/employees. Every business is different to be sure, but these classic turnaround strategies will apply to almost all of them. I’ve outlined some steps to get you started, with additional detail below. Even if you don’t own a company, you can employ some of these strategies for your household.

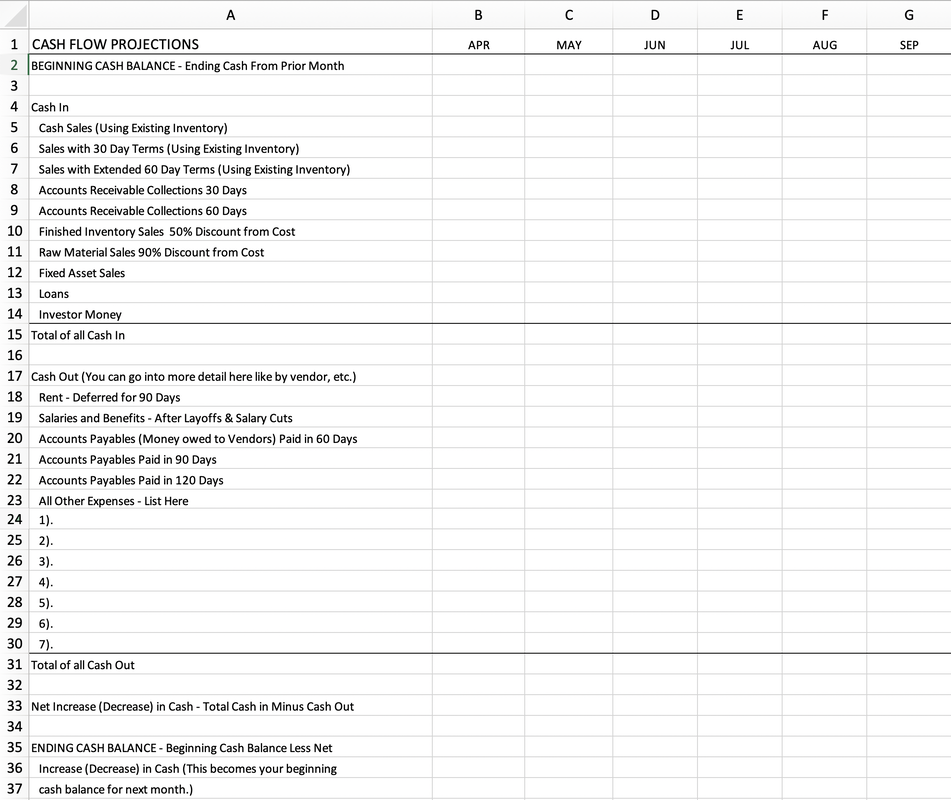

Don’t freeze. I know you may feel paralyzed right now, but the most important thing is to be in action — not motion, but action. What is the difference? James Clear explains it perfectly in his book, “Atomic Habits.” Motion is a planning process, a thinking, a mulling it over if you will. Action is actually doing it. Let’s say you want to write an article. Motion is sitting around thinking about it. Turning over the story in your mind’s eye. Maybe even doing research or making notes. But at a certain point, you have to sit down and write. That’s action. If you want to survive, you must be in action like Nike’s great slogan, “Just Do It”. Estimate how long this downturn will last. You may be wrong, but you may be right or only slightly wrong. Collect all the information you can and then take your best shot at estimating. That’s what projections are anyway — your most educated guess as to what is going to happen. If you at least have a set of assumptions and the resulting actions based on those assumptions, it is easier to make adjustments than it is to start from scratch or to have no plan whatsoever. Collect and hoard cash. See how much cash you have. This includes checking and savings accounts, bank lines of credit, credit cards, cash on hand, and investor commitments. (Confirm those commitments.) Tally up your accounts or loans receivable (money your customers or others owe your company) if you have any. Make an aggressive effort to collect all of that as soon as possible, even offering a discount if you can get a large portion now. If you have open lines of credit, borrow the maximum on them and tuck it away. Remember, in times of difficulty, Cash is King. Ironically, I recently wrote about that. You can find it here. As an example, last week when a large tenant of mine asked for a 50% discount on his monthly rent, I offered, if he paid me in full for April, I’ll waive the following two months rent. That would result in a 66% discount for him. But I’m getting the cash up front. Who knows? He may go out of business next month. His company perhaps cannot be saved. Salvage outstanding orders. How many orders can you save using existing inventory? Don’t make any new inventory unless you have an order that will use all of it and at a good price. Call all your customers. Maybe give them extra terms. Let them know that if they take your goods in today, you will give them sixty or even ninety days to pay for them. If they buy now, you’ll give them a discount. Better to get something for your inventory than to have it sitting in the warehouse. Project cash coming in. On a spreadsheet or piece of paper, write out the name of each month until you assume this will end. If you think it will be over in six months, then make the heading on top for the next six months — APR, MAY, JUN, JUL, AUG, SEPT, OCT. Write down your best estimate (based on the data collection you just did by questioning your customers), of your cash in — not just your sales — but when you will collect the money. Also include in cash, the amount of receivables you think you will collect under the month that you think you will collect them. This is the first part of a cash flow statement — when the cash is coming in. And be super honest and realistic with yourself. I’ve constructed a rudimentary Cash Flow Projection you can use as a template below. Project cash going out. If you are to make no changes, what are your expenses in the month the cash is going out? Look at keeping all your staff, paying your rent in full, payroll taxes, utilities, commissions, shipping, postage, etc. Subtract your monthly expenses from your estimated revenue. See what your shortfall is each month. If you have a shortfall of $10,000 every month and you have access to $30,000 in cash, then you’ve got three months of runway. That’s your worst case scenario. Now for the important part — let’s improve upon that. What are the two main categories of improvement? Increase or speed up cash in. Or decrease or slow cash out. Explore alternative sources for cash. As an example, find out how much money you can get from the SBA (Small Business Administration). The SBA is guaranteeing loans for companies and if you can keep your employees, it turns into a grant (which means you don’t have to pay it back). Make that adjustment of cash in the column of whatever month you can safely assume you’ll receive it. Can you liquidate any of your inventory? If you don’t have enough sales to use up your existing inventory (goods on hand or in your warehouse), then see if you can sell them for a “closeout” price — which usually means for ten cents to fifty cents on the dollar. If you are making a gadget that costs you $1.00, you will sell it for 50 cents. There are closeout companies in your industry. I guarantee it. Google it. Ask friendly competitors.They are out there. You’ll book a loss, but we’re concerned with cash here, not losses. Cut or slow down cash out. If you can slow down your payables (people you owe money to), or negotiate longer terms, or a lesser interest rate to your bank if you owe money, or deferred rent, or reduced shipping costs or wherever you can save money — do it and don’t wait. Like my friend, if all your sales are now online, then look at your server costs (believe it or not there can be a huge difference), drill down on your shipping costs, (pit Fedex against UPS or USPS), that’s a simple one and can be easily delegated. How can you save money on packaging? Boxes? Labels? If it’s a food company, it may be less expensive to overnight your items than pay for dry ice. Just be creative. Think outside the shipping box. Weed out lower profit margin products or services. Look at your product mix. You should know how much gross profit you are making on each product/product line. Gross profit is the sales price of a product or service less what it costs to produce or provide it. If it’s less than 30% of sales, consider dropping it. As an example, if your main product is pizza, but you supplement that by salads and wings and you make a 30% gross profit margin on wings, and only 20% on salads, then consider dropping salads from your line. It pains me to say this because I’m a vegetarian, but I’m not really your customer, am I? Trust me, there are still plenty of people that buy pizzas. If you don’t know your profit margins for each of your products, hire a good bookkeeper. I can recommend one. Or ask your accountant to help you (for a deferred payment or perhaps even barter). Free pizzas for life! Pun intended. Yes, don’t lose your sense of humor, not now as you may need some levity to balance the balance sheet of stress. Employees you should keep. If you are a consumer products company that sells to other retail stores, then your salespeople are gold. If you sell online, then your marketing people are gold. Look at where your business is right now, and lay off employees that you don’t directly need for what you’re doing right now. When things get back to somewhat normal, then you can re-adjust your employee mix. A word: please try to make this your last possible option. We’re all in this together and laying off employees will have ripple effects. If you can, perhaps try to pay everyone at half salary. After you’ve examined all of this — and this is not a gut instinct situation, this is an information gathering and numbers crunching situation, make a plan and meet with your stakeholders. They may include, board of directors, investors, and partners. Come armed with your six month projections and assumptions. Be forthcoming. If you have completely honest and well-thought out information and research backing up a Master Plan, they will be much more likely to support you. Schedule a meeting with your bank. If you need them to lend you more money, and show them your realistic and conservative Master Plan, you have a better shot. If you can’t make your payments on a timely basis, then tell them. As a former banker I can tell you one important fact: bank’s don’t like surprises. Yes, it’s true. Your bank or investor or factor will be much more likely to support you if you meet with them, clutching your Master Plan in hand with an up-to-the-moment financial picture. This is not an online dating profile with a ten-year old photo. They don’t want you to bullshit them; they not only want you to succeed, they need you to succeed. They don’t want to be left in the dark either. Give them the honest information up front and keep them updated with excruciating frequency. Weekly at minimum, daily if necessary. You would rather that they’re sick of you — “OMG, it’s her again” — than for them to be wondering, “what ever happened to her? I haven’t heard from her in months!” It’s probably not comfortable, but it’s always better. I have three final words for you: plan, plan plan. You must start and finish with a plan. Be conservative (provide a cushion). Change it as you go. Communicate it to everyone relevant. And remember, this too shall pass. Here is that Cash Flow Template I mentioned:

0 Comments

Leave a Reply. |

Stories and snippets of wisdom from Cynthia Wylie and Dennis Kamoen. Your comments are appreciated.

Archives

June 2024

Categories |